UK: HMRC company car advisory fuel rates from 1 September 2025

- Farrell & Farrell

- Aug 26, 2025

- 1 min read

These HMRC rates only apply to:-

• Reimburse employees for business travel in their company cars; or

• Require employees to repay the cost of fuel used for private travel

Electric cars - from 1 September 2025 the advisory electric rates for fully electric cars will be:-

• 8p per mile for home charging

• 12p per mile for public charging

Electricity is not a fuel for car fuel benefit purposes.

When employees are reimbursed up to the advisory fuel rates for business travel in their company cars, HMRC will accept there is no taxable profit and no Class 1A national Insurance arising.

Hybrid cars are treated as either petrol or diesel cars for this purpose.

HMRC reviews these rates quarterly.

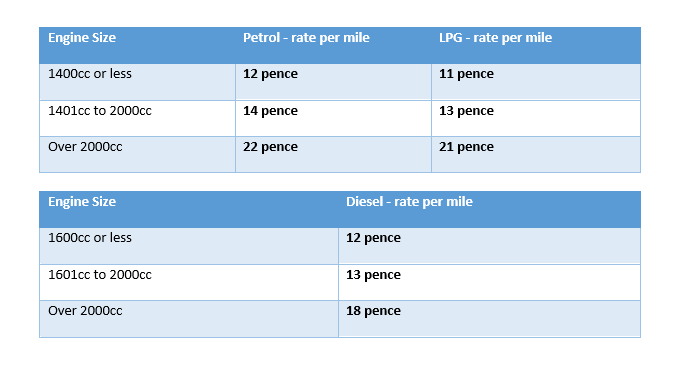

Advisory fuel rates from 1 September 2025:

#FarrellAndFarrell #crossbordertaxadvisors #crossborder #taxadvisors #uktaxadvisors #roitaxadvisors #accountantcountydown #accountantnearme #newryandmourne #accountantscodown #accountantsnewry #HMRC #FuelRates

Comments